Galaxy Digital's Massive Bitcoin Transfers Stir Market Ahead of Fed Decision

Galaxy Digital Handles $9B Bitcoin Sale Without Market Crash: What It Means for the Crypto World

Galaxy Digital, the prominent cryptocurrency investment and financial services firm led by Mike Novogratz, is making headlines again after executing one of the largest Bitcoin transactions in history. Over the past week, the firm has reportedly assisted a long-time investor in offloading over 80,000 BTC, valued at more than $9 billion. Yet, despite the colossal size of this sale, the Bitcoin market remained surprisingly stable—a feat that could indicate increasing resilience and maturity in the crypto sector.

|

| Source: X |

Discreet Yet Massive: The $9 Billion Transaction

Between July 21 and July 27, Galaxy Digital quietly processed a Bitcoin transaction that many thought would send shockwaves through the market. The seller, rumored to be a holder from the so-called "Satoshi Era," had reportedly held the digital asset since Bitcoin's early days. Galaxy handled the transaction with precision, dispersing the BTC through multiple wallets and platforms to avoid creating panic.

|

| Source: CoinMarketCap |

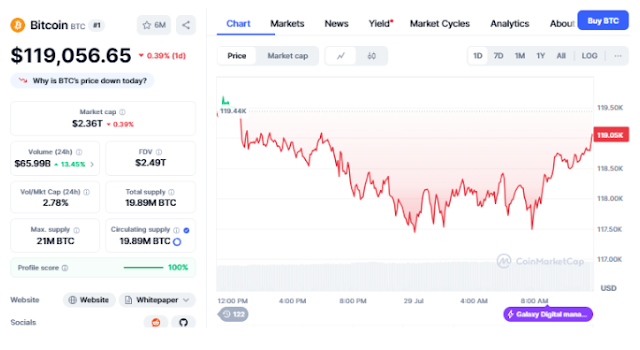

Despite the scale of the sale, Bitcoin's price only briefly dipped below $115,000 before recovering. By July 29, BTC was trading around $119,056, down only 0.39% from the previous day. Meanwhile, trading volume surged by 15% to reach $85.99 billion, indicating heightened market activity but not chaos.

Another Wave of BTC Outflows Raises Eyebrows

While the $9 billion transaction was still fresh in the minds of traders, Galaxy Digital moved an additional 3,782 BTC (valued at approximately $447 million) within the past 12 hours. According to blockchain analytics platform Lookonchain, these funds were transferred to major cryptocurrency exchanges—typically a sign of upcoming sales.

This follows a July 25 move when Galaxy shifted nearly 30,000 BTC, worth about $3.5 billion, and withdrew $1.15 billion worth of USDT from crypto exchanges. These movements have sparked debates in the crypto community about whether Galaxy is merely handling routine transactions or preparing for another large-scale liquidation.

As of now, Galaxy Digital reportedly holds 18,504 BTC, with a market value of approximately $2.14 billion.

Why Sell Now? Exploring the Possible Motivations

The timing of these sales has raised speculation. Industry analysts suggest multiple factors could be behind this massive offload:

Macro-Economic Concerns: The U.S. Federal Reserve is expected to make a key interest rate decision on July 29-30. With inflation still running above target, most experts believe there will be no rate cuts this time. Higher interest rates tend to reduce the attractiveness of risk assets like cryptocurrencies.

Profit-Taking: Bitcoin has seen a significant surge in recent months. Long-term holders may be looking to lock in gains, especially after riding the wave from Bitcoin’s early days to its current price point.

Estate Planning: Reports suggest that the 80,000 BTC sale was part of a long-term estate planning strategy rather than a reaction to market trends. This aligns with the idea of large, strategic asset shifts among early crypto adopters.

How the Market Responded: Stability Amid Chaos

Despite fears that such a massive sale would send Bitcoin's price plummeting, the opposite happened. Market participants were impressed by how Galaxy Digital managed the offload. The firm’s careful and staggered approach avoided flooding the market, allowing BTC to absorb the pressure.

"This kind of strategic execution demonstrates the evolution of the crypto market infrastructure," said a senior trader at a U.S.-based crypto fund. "Five years ago, a sale of this magnitude would have caused absolute panic. Today, it was almost a non-event."

Moreover, the dip that followed the initial sale appears to have attracted new buyers. Some investors saw the brief decline as an opportunity to enter or reaccumulate, further stabilizing the price.

Market Tensions Rise Ahead of Federal Reserve Meeting

Adding to the market tension is the upcoming U.S. Federal Reserve meeting. With inflationary pressures lingering and no imminent rate cuts expected, some traders are repositioning portfolios away from volatile assets like crypto. Others see this as a temporary phase.

"Even if rates stay high in the short term, the long-term narrative for Bitcoin remains strong," said Emily Carter, a macro analyst at Arcview Investments. "Institutional adoption, limited supply, and global monetary uncertainty still play in Bitcoin’s favor."

This sentiment is echoed across several crypto trading forums and institutional research papers. Many remain optimistic about Bitcoin's trajectory through the rest of 2025 and into 2026.

Galaxy Digital: A Quiet Giant in a Noisy Market

Galaxy Digital's ability to process a $9 billion transaction without triggering volatility has not gone unnoticed. Industry insiders are now viewing the firm as a benchmark for responsible institutional crypto asset management.

"They didn’t just sell Bitcoin—they sold confidence," said Andre Liu, co-founder of a digital asset fund in Singapore. "Their handling of this sale may actually encourage more high-net-worth individuals and institutional players to enter the space."

Moreover, the latest $447 million BTC movement to exchanges suggests that Galaxy may not be done yet. If the company continues to act as a broker for other long-term holders looking to exit positions, this could become a recurring theme in the latter half of 2025.

Looking Ahead: Bullish Signs Despite Sell-Offs

Despite recent sell-offs, long-term sentiment in the crypto space remains overwhelmingly positive. Analysts note that BTC continues to hold above crucial support levels, and no significant technical breakdowns have occurred.

"We’re seeing a classic accumulation pattern," said Alex Huang, head of strategy at TokenMetrics. "Big players are selling into strength, and retail and mid-sized investors are picking up those coins. It shows a maturing market dynamic."

In addition, recent data indicates increasing on-chain activity and wallet creations, which are considered leading indicators of growing user engagement.

Conclusion: A Market Growing Up

The recent Galaxy Digital Bitcoin moves serve as a pivotal case study in how far the cryptocurrency ecosystem has evolved. The firm’s ability to liquidate billions of dollars in Bitcoin with minimal market disruption suggests a newfound robustness in the digital asset economy.

As the world waits for the Federal Reserve’s next move and macroeconomic trends continue to unfold, all eyes remain on firms like Galaxy Digital. For now, their careful navigation of one of the largest BTC sales in history paints a bullish picture for what comes next.