Bitcoin Halving: Understanding Key Events in the Crypto Ecosystem - hokanews

hokanews.com - Bitcoin, as the world's most popular digital currency, has been in the limelight since its launch in 2009 by someone known by the pseudonym, Satoshi Nakamoto. In the course of its history, Bitcoin has experienced a series of important events that have affected the dynamics of the crypto market as a whole.

What is Bitcoin Halving?

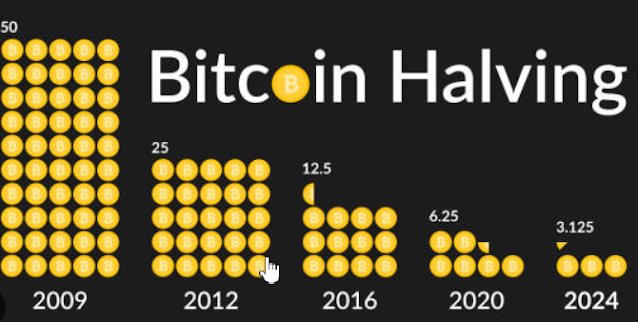

Bitcoin Halving is an event that is set automatically in the Bitcoin protocol, in which the reward given to miners for mining new blocks is significantly reduced. Initially, the block reward was 50 Bitcoins for each successfully mined block. However, every time 210,000 new blocks are mined, this reward is halved. This means that on the first halving, the prize is reduced to 25 Bitcoins, on the second halving to 12.5 Bitcoins, and so on.

Why is the Bitcoin Halving Important?

The Bitcoin Halving has several main goals designed to control inflation and regulate the rate at which the supply of Bitcoin grows. By reducing the new supply that comes into circulation, the halving aims to maintain the value of Bitcoin and prevent runaway inflation. In addition, the halving also creates an incentive for miners to continue to contribute to the security of the Bitcoin network, as they are still rewarded even if the amount is reduced.

The Impact of the Bitcoin Halving on Crypto Prices and Markets

One of the frequently asked questions is how the Bitcoin halving affects the price of this crypto asset. The impact of halvings on the price of Bitcoin can vary, but history has shown that halvings are often followed by significant price increases within the next few months to a year. Some of the potential reasons for this increase in price include the perception that limited supply will increase demand, as well as the psychological effect of encouraging investors to hold Bitcoin as a long-term asset.

However, it's important to remember that price increases don't always occur after a halving. Other factors such as market sentiment, regulatory changes and external events can also affect the price of Bitcoin and the overall crypto market.

Preparation and Anticipation

As one of the key events in the crypto ecosystem, many market participants and investors are getting ready for the Bitcoin halving. Experts and analysts often provide guidance and perspectives on how halvings can affect the market. In addition, many investors also use halvings as a moment to reflect on their investment strategy and consider potential risks and returns.

One of the interesting aspects about Bitcoin halvings is their ability to be compared to previous halvings. Seeing how the market has reacted to previous halvings can provide valuable insight into how current halvings may affect market price and activity. This is important because each halving may have different market conditions and may present new challenges or opportunities.

A comparison between the price before and after the previous halving can give an idea of the potential future price trend. However, keep in mind that the past does not always reflect the future, and the crypto market is extremely complex and difficult to fully predict.

Impact on the Altcoin Market

As well as affecting Bitcoin, halvings can also have an impact on the market for altcoins or cryptocurrencies other than Bitcoin. Some altcoins that are correlated with Bitcoin or have similar features such as halving may experience price movements in line with Bitcoin.

However, there are also altcoins that have unique characteristics and are not completely affected by the Bitcoin halving. The altcoin market often has different dynamics and is influenced by factors that are specific to each of these crypto assets.

Diversification and Risk Management

The Bitcoin halving is an important moment for investors to contemplate diversification and risk management strategies in their crypto portfolios. As one of the most dominant crypto assets, an increase in the price of Bitcoin can cause big changes in portfolio composition.

Investors should consider diversifying their portfolio to include other altcoins that have different prospects and goals. By diversifying, investors can reduce the risk associated with single price fluctuations and increase the chances of profit in the long term.

The Bitcoin Halving is a key event in the crypto ecosystem that occurs about once every four years. The halving reduces the block reward to Bitcoin miners, with the aim of controlling inflation and regulating the pace of growth in the Bitcoin supply. This event has repeated several times since the launch of Bitcoin in 2009, and will continue until the maximum total supply of 21 million Bitcoins is reached.

The impact of halvings on the price of Bitcoin and the crypto market as a whole can vary and is influenced by a variety of factors. While halvings are often followed by an increase in the price of Bitcoin, the crypto market is extremely complex and difficult to predict with certainty.

Investors need to understand the importance of portfolio diversification and risk management in dealing with halvings and market changes. By considering other crypto assets besides Bitcoin, investors can reduce the risks associated with single price fluctuations and increase the chances of profit in the long term.

In understanding and dealing with the Bitcoin Halving, a careful approach, thorough research, and consulting with financial experts is highly recommended. Thus, investors can achieve optimal profit potential and manage the risks associated with investing in crypto assets in the future.

It should be remembered that the crypto market is an extremely high-risk market, and all investment decisions should be made with full consideration and understanding of the potential risks and returns associated. The Bitcoin Halving is a watershed moment in the crypto ecosystem, and in-depth knowledge of this event will help investors understand the market changes that can occur and take the right steps in building their crypto portfolio.